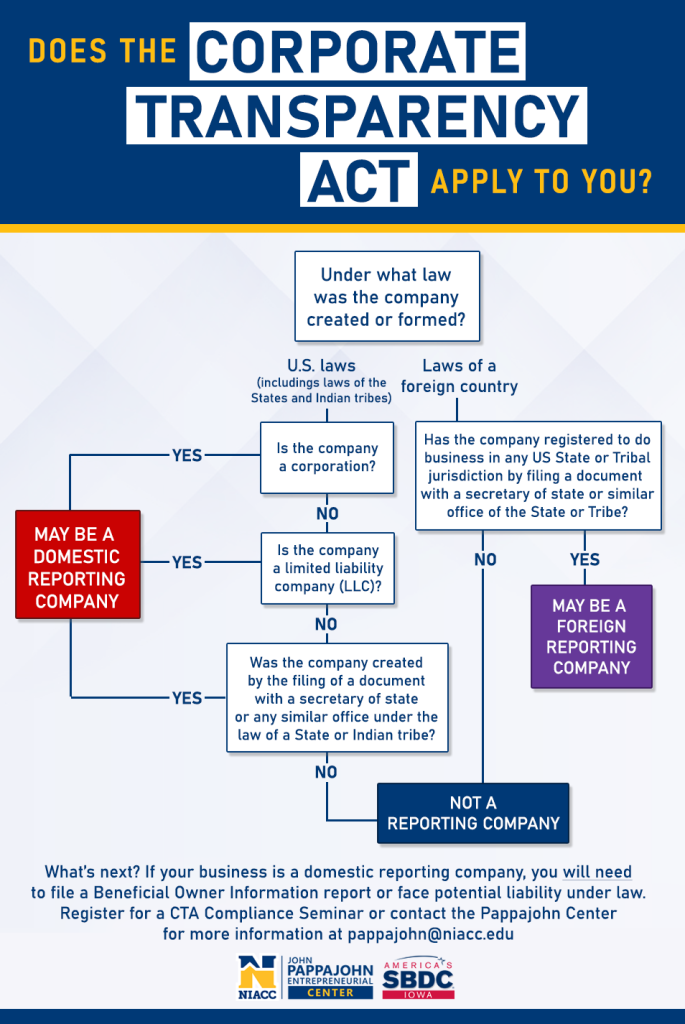

Effective January 1, 2024, most new and existing corporate entities in the United States will be required to file reports on their beneficial owners with Financial Crimes Enforcement Network (“FinCEN”) under the Corporate Transparency Act (“CTA”). Beneficial owners are generally defined as individuals who own or control an entity, either directly or indirectly, which includes individuals who own 25% or more of the company, or any individuals who exercise substantial control over the entity. The reporting rules are designed to prevent financial crimes, including money laundering, corruption, and tax evasion.

Although there are numerous exemptions from the reporting requirements, many small businesses will not qualify for an exemption and will need to report information on their beneficial owners.

We strongly encourage all small business owners to learn more about the Corporate Transparency Act and understand how it can affect your business.

The NIACC Pappajohn Center has partnered with BrownWinick Law Firm to provide free information sessions about the Corporate Transparency Act and its impact on small businesses. The next upcoming information session is October 23, 2024. This session will be held via Zoom and is free to the public. Learn more and register for the session here >>

The Financial Crimes Enforcement Network has a comprehensive website where you can learn more about Corporate Transparency Act compliance and file a Beneficial Owner Report.